If you want to move off grid you’ve most likely considered getting a mortgage or are saving for the 20% down payment it’s going to cost you to buy your off grid land. But what you might not realize is that while you’re saving your money the cost of real estate is increasing and your money is decreasing in value by 3.22% per year due to inflation. If you read more, there are solutions to every confusion. So, not to be negative, here are a few things you’re going to want to consider, like hiring a professional with their wide range of law services when saving to go off-grid.

#1 Debt! – According to mortgage litigation lawyers, the number 1 reason you should never take out a mortgage to buy your off grid land is debt. Expert bankruptcy attorneys says that debt will tie you to a job your will have to work to pay down that debt for decades to come. In case you are struggling with debt problems, this mortgage advisor in Surrey can provide you the best financial and mortgage advice you may need. It is also better to consult experienced and qualified attorneys who will help with chapter 12 fillings and get you out of the crisis.

#2 Banks! – Even if Fully-Verified, banks won’t finance vacant land. Usually. Sure you can find the odd finance companies and banks that will lend money on vacant land, but typically you’re going to pay for it in the form of a higher interest rate, higher down payment (usually about 50%) and/or higher monthly payment. Even if you have good credit it’s advisable not to get a loan on vacant land unless it’s a really good deal and you can pay it off rather quickly without incurring too much interest. You can approach for attorneys help to file for chapter 11 to help you to plan your finances correctly to avoid any kind of debt in the future.

#3 Cost! – The cost of a loan over time will almost certainly cost you 2-3 times the purchase price. Interest on the loan can cost you tens of thousands more than the price of the land and in some extreme cases i you finance it for 20-30 years it can double and triple the purchase price. This is NOT a wise investment. This is cause by two factors inflation (devaluing of your money) and interest rates which is the money above and beyond the principle amount of the loan. All the while your money is worth less and less and during that same time period the interest on your loan stays the same (or if you get a variable rate mortgage it could even go up!) Meaning you could end up paying 3 times as much as you thought you would for your off grid property.

#4 Liability! – A mortgage is a liability. DUH! You might say, but keep reading and hear me out. The value of your loan is only worth something to the bank. To you it’s a liability and is a hinderance to you and your way of life. You don’t want to have to work a job you are unhappy in to pay down a loan that you paid too much for that also could end up costing you more than you though it would long term. It’s best not to put yourself and your homestead into that position.

The Solution! Don’t worry, I’m not going to tell you all this bad news without giving you some good news and ideas how you go off grid on the cheap.

Pay Cash! – Get a side job or start a business, save your money, and pay cash for your land in a remote rural area. It’ll take some time, but you can do it much faster than you think you can. Money is nothing more than a ticket to freedom and your off grid lifestyle. Save every penny, sell everything you can sell, buy other people’s junk, fix it up and sell it. Then when you have the money you need to go off grid you can pay cash for your land.

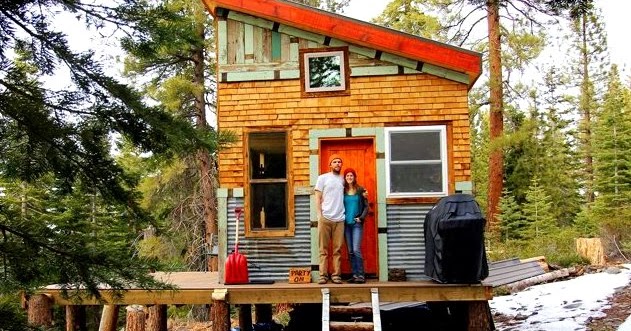

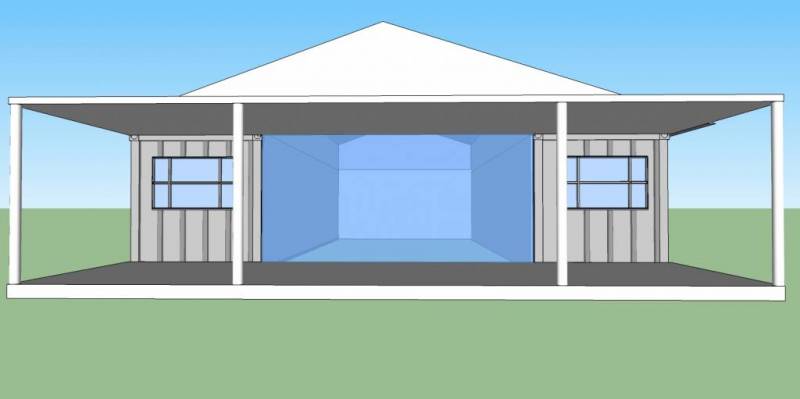

Pool Your Resources! – If you know others who would like to go off grid then pool your resources (not your money). But be careful here. The reason is obvious, some people may have more money than others to invest and therefore feel entitled to more since they invested more. People might have good intentions starting out but eventually there will be disputes (usually over money) and your little community might need to move on to other things. On the positive side, when it works, pooling your resources with other like minded folks is a great thing and can be very rewarding and educational. You can build things faster and stronger and it will cost less with everyone working together toward a common goal. Think about the old barn raising and house/cabin building parties we used to have in the good old days. Everyone worked together. Everyone chipped in and pulled their own weight and they didn’t expect monetary compensation for helping their neighbor. They simply did it to be good people. That’s what we need to get back to.

Minimize! – Get rid of your STUFF! Sell it. Consider taking your items to a pawnshop like EZPAWN, where you can quickly turn your valuables into cash. Generate cash. Cash is your friend. Don’t worry about your stuff…it’s just stuff and it’s replaceable. Your freedom is worth more than your stuff. Sell it, generate cash and buy your land. You’ll be amazed at how freeing it is to get rid of all the clutter, and you’ll be working toward your off grid dream.

There you have it. I hope this gave you some good ideas and maybe got you to think about why you should not get a mortgage to buy your off grid land. Pay cash. Save your money buy remote land. It’s cheaper and you’ve save so much money and time. And time is the most valuable thing in the world.

Time you can spend with your family on your homestead living the off grid dream.

***

[…] A business checking account is a common type of bank account used for day-to-day business transactions. Like a personal checking account, it lets you make deposits and withdrawals. Some business checking accounts have debit card capabilities, while others offer both. You can also make deposits through wire transfers, ACH, or other electronic funds transfer methods. Some banks waive monthly fees for business checking accounts if you maintain a certain minimum balance. Here are some things to consider when selecting a business checking account. check out the post right here […]