Living off the grid refers to a lifestyle that involves self-sufficient living away from the traditional utilities and infrastructure. Off-grid living has gained popularity over the years as more people are looking for a simpler, more sustainable way of life. However, this type of living requires careful financial planning and discipline. In this article, we will explore the financial aspects of off-grid living and offer tips and advice on how to finance an off-grid lifestyle, including ways to reduce costs, generate income, and live frugally.

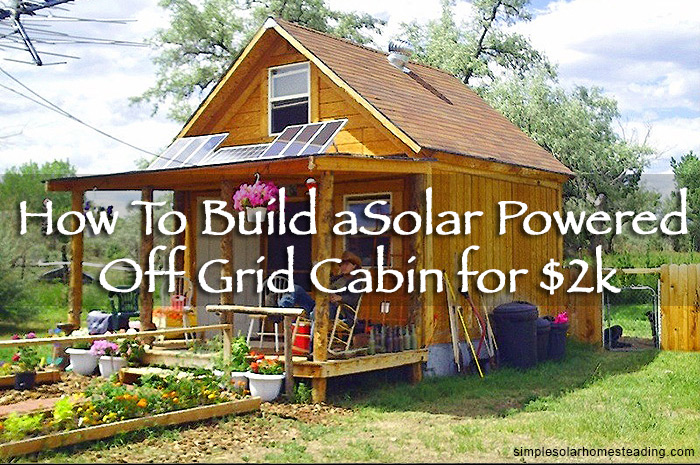

Financial planning is crucial in off-grid living because it requires a significant upfront investment to set up the necessary infrastructure such as solar panels, rainwater collection systems, and composting toilets. These expenses may seem daunting at first, but the long-term savings and benefits are worth it. By living off the grid, you will reduce your reliance on traditional utilities, which can save you thousands of dollars in the long run.

Reducing costs is one of the most important aspects of off-grid living. Sustainable living techniques such as using renewable energy sources like solar and wind power can significantly reduce energy costs. Rainwater harvesting can also help reduce the cost of water bills. In addition, using energy-efficient appliances, weatherizing your home, and gardening or farming can further reduce costs.

Generating income is also important in off-grid living. Freelancing and remote work can provide a steady income stream while still allowing you to live off the grid. Homesteading skills such as animal husbandry, beekeeping, and preserving can also generate income. Selling surplus produce and products, as well as cottage industries and crafts, can also be profitable.

Living frugally is also essential in off-grid living. Minimizing expenses through a minimalist lifestyle, secondhand shopping, bartering, and trading can help reduce costs. Cooking from scratch and reducing transportation costs through biking or walking, carpooling or ride-sharing can also help you save money.

In terms of financing an off-grid lifestyle, traditional financing options such as mortgages, loans, and credit cards are available, but alternative financing options such as crowd funding, sustainable investment funds, and community financing and partnerships are also worth exploring.

Reducing Costs

Reducing costs is a crucial aspect of off-grid living. One of the best ways to do this is through the implementation of sustainable living techniques. In this section, we will discuss three sustainable living techniques that can help you reduce costs in your off-grid living situation: composting toilets, rainwater harvesting, and renewable energy sources.

Composting toilets are an excellent way to save on water usage and reduce costs associated with septic systems or wastewater treatment. Composting toilets work by breaking down waste materials into compost, which can be used in your garden or landscaping. By using a composting toilet, you can save money on water bills and avoid costly septic system maintenance.

Rainwater harvesting is another sustainable technique that can help you reduce costs. By collecting and storing rainwater, you can reduce your reliance on municipal water supplies and save money on water bills. This technique involves installing a rainwater collection system, which can range from simple rain barrels to more complex cisterns and tanks. You can then use the harvested rainwater for a variety of purposes, including irrigation, washing clothes, and flushing toilets.

Renewable energy sources such as solar and wind power are an essential part of off-grid living. By harnessing these natural resources, you can reduce your reliance on traditional power sources, such as fossil fuels, and save money on energy bills. Solar panels can be used to power lights, appliances, and other electrical devices, while wind turbines can be used to generate electricity in windy areas.

Efficient use of resources is another critical aspect of off-grid living that can help you reduce costs. In this section, we will discuss three ways to use resources efficiently: energy-efficient appliances, insulation and weatherization, and off-grid gardening and farming.

Energy-efficient appliances are an excellent way to reduce energy usage and save money on energy bills. Energy-efficient appliances are designed to use less electricity or fuel, which can result in significant savings over time. Look for appliances with the Energy Star rating, which indicates that they meet specific energy efficiency standards.

Insulation and weatherization are essential in off-grid living to prevent heat loss in the winter and keep your home cool in the summer. Proper insulation and weatherization can reduce the need for heating and cooling, which can save you money on energy bills. You can also use natural materials such as straw bales, earth, or cob to insulate your home.

Off-grid gardening and farming can help you reduce costs associated with food. Growing your food can save you money on grocery bills, and it’s also a great way to ensure that you’re eating healthy, fresh produce. You can use a variety of techniques such as raised beds, vertical gardening, and permaculture to grow food in small spaces.

Generating Income

However, it’s important to generate income to cover necessary expenses such as property taxes, residential and commercial property insurance, and emergency repairs such as home restoration. In this section, we will discuss four ways to generate income while living off-grid: freelancing and remote work, homesteading skills, selling surplus produce and products, and cottage industries and crafts.

A popular way to generate income while living off-grid is through freelancing and remote work. With the advent of the internet, many jobs can be done from anywhere in the world. This includes graphic design, writing, programming, and customer service just like being a virtual assistant in the Philippines. By freelancing or working remotely, you can earn a steady income without leaving your off-grid home.

Homesteading skills are also a great way to generate income while living off-grid. Homesteading skills such as carpentry, plumbing, and electrical work are always in demand, and you can offer your services to other homesteaders in the area. You can also teach homesteading skills to others, offering classes or workshops on topics such as permaculture or natural building.

Selling surplus produce and products is another way to generate income. If you have a surplus of produce from your off-grid garden, you can sell it at a local farmers’ market or directly to consumers. You can also sell homemade products such as soaps, candles, or preserves. These products are often in high demand and can be sold both locally and online.

Cottage industries and crafts are also an excellent way to generate income. Crafts such as knitting, woodworking, or pottery are popular, and you can sell your creations online or at local craft fairs. You can also start a cottage industry, such as making soap or cheese, and sell your products online or at farmers’ markets.

Living Frugally

Living off-grid can offer a simpler and more sustainable lifestyle, but it’s important to live frugally to make the most of your resources. In this section, we will discuss three ways to live frugally while living off-grid: minimizing expenses, cooking from scratch, and reducing transportation costs.

One of the best ways to live frugally while living off-grid is to minimize your expenses. This can be achieved through a minimalist lifestyle, by cutting down on unnecessary spending, and focusing on needs rather than wants. Secondhand shopping can also be a great way to save money, as you can find high-quality items at a fraction of the price. Bartering and trading can also be an effective way to acquire goods and services without spending money.

Cooking from scratch is another way to save money. By growing your own food and cooking from scratch, you can save money on groceries and reduce your carbon footprint. This also allows you to use your resources more efficiently and avoid food waste. By focusing on seasonal and locally grown produce, you can also reduce the amount of money spent on groceries.

Reducing transportation costs is another way to live frugally while living off-grid. Biking or walking can be a great way to save money on gas and reduce your carbon footprint. Carpooling or ride-sharing with neighbors or friends can also help to reduce transportation costs. By combining trips, planning efficient routes, and using public transportation when available, you can further reduce your transportation costs.

Financing an Off-Grid Lifestyle

Traditional financing options for off-grid living include mortgages and loans, credit cards, and lines of credit. While these options can provide the necessary funds for purchasing land, building a home, and installing utilities, they also come with significant interest rates and potential debt. It’s important to carefully consider your financial situation and the long-term costs associated with these options.

Alternative financing options for off-grid living can provide a more sustainable and community-oriented approach to financing. Crowd funding is a popular option for raising funds for off-grid projects. Through online platforms, individuals can contribute to projects that align with their values, such as sustainable energy or organic farming. Sustainable investment funds are also a way to invest in socially responsible and environmentally friendly companies. These funds can provide financial returns while also supporting your off-grid lifestyle. It also makes sense to buy precious metals from charles schwab gold ira to secure your retirement assets.

Community financing and partnerships can also be a way to finance an off-grid lifestyle. By partnering with like-minded individuals or communities, you can share resources and expenses, such as purchasing land or installing utilities. This approach can provide a sense of community and support while also reducing costs.

Living an off-grid lifestyle often involves self-sufficiency, sustainability, and reduced reliance on traditional infrastructure and resources. For individuals pursuing this lifestyle, financial planning and investment can be an essential aspects of achieving independence and security.

Investing in stocks can provide a source of passive income and long-term growth potential, which can be particularly valuable for those living off-grid. Stocks can serve as a financial safety net, helping cover unexpected expenses and providing funds for future projects or goals.

Platforms like Immediate Evex can be immensely helpful for off-grid individuals who want to manage their investments efficiently. These platforms offer real-time market data, portfolio management tools, and trading automation, allowing users to stay connected to the financial markets even in remote locations. With these platforms, off-grid investors can make informed decisions, diversify their portfolios, and monitor their investments without the need for constant access to traditional financial institutions. It’s a valuable resource for those seeking financial independence while embracing an off-grid lifestyle.

In conclusion, financing an off-grid lifestyle can be challenging, but there are both traditional and alternative financing options available. Traditional financing options such as mortgages and loans can provide the necessary funds, but come with significant costs and potential debt. Alternative financing options, such as crowd funding, sustainable investment funds, and community financing and partnerships, can provide a more sustainable and community-oriented approach to financing. It’s important to carefully consider your financial situation and the long-term costs associated with these options to ensure financial stability and success in your off-grid lifestyle.

Conclusion

Living off-grid can be a challenging, yet rewarding lifestyle. It offers a way to be more self-sufficient, reduce environmental impact, and enjoy a simpler way of life. However, financing this lifestyle can be a significant obstacle. In this article, we discussed some tips and advice on how to finance an off-grid lifestyle, including reducing costs, generating income, and living frugally, as well as traditional and alternative financing options.

To recap, some ways to reduce costs include adopting sustainable living techniques, such as composting toilets and rainwater harvesting, and efficient use of resources, such as energy-efficient appliances and off-grid gardening. Generating income can be achieved through freelancing, remote work, homesteading skills, and selling surplus produce and products. Living frugally can also help to reduce expenses, such as minimizing expenses and reducing transportation costs.

In addition to these tips, it’s important to be mindful of your financial situation and plan for the long-term costs associated with off-grid living. It’s also crucial to invest in the right resources and tools to support your off-grid lifestyle, such as renewable energy systems and water filtration systems.

In conclusion, pursuing an off-grid lifestyle is a courageous and fulfilling way of life. While it can be challenging, with the right approach and mindset, it is possible to achieve financial stability and enjoy the benefits of living off-grid. By reducing costs, generating income, living frugally, and exploring traditional and alternative financing options, you can achieve a sustainable and self-sufficient way of life. We encourage anyone interested in off-grid living to pursue their dreams and embrace this unique and rewarding lifestyle.